Abstract

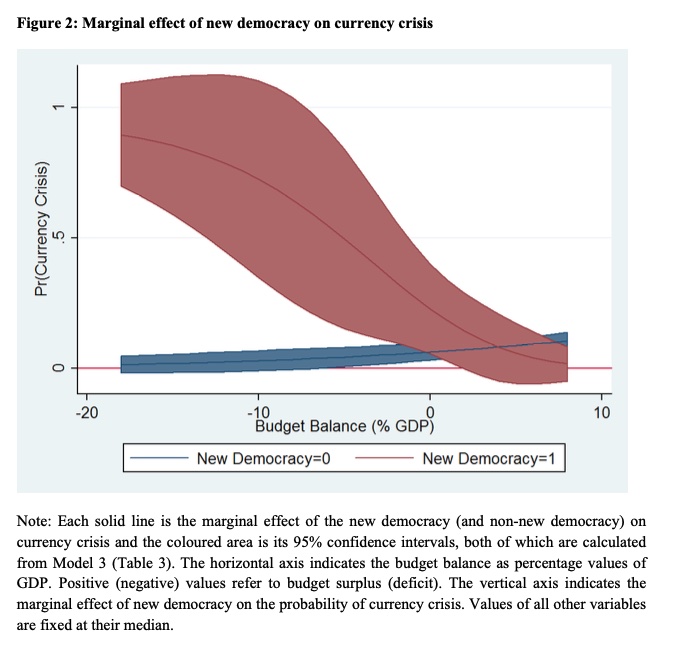

Latin America experienced a deep political transformation from authoritarianism to democracy in the recent decades. During the same period, many countries in the region also suffered severe currency crises. We contend that these two phenomena are causally related. Specifically, we argue that democratic transitions increase political demand for public spending, leading to budget deficits, and this increases investors’ propensity to liquidate local currency holdings. Moreover, we note an important ‘threshold’ effect, in which democratisation is particularly likely to lead to currency crises when the pre-existing fiscal deficits are already relatively high. Statistical analysis confirms these arguments in a sample of 25 Latin American countries in the period from 1975 to 2008.