Abstract

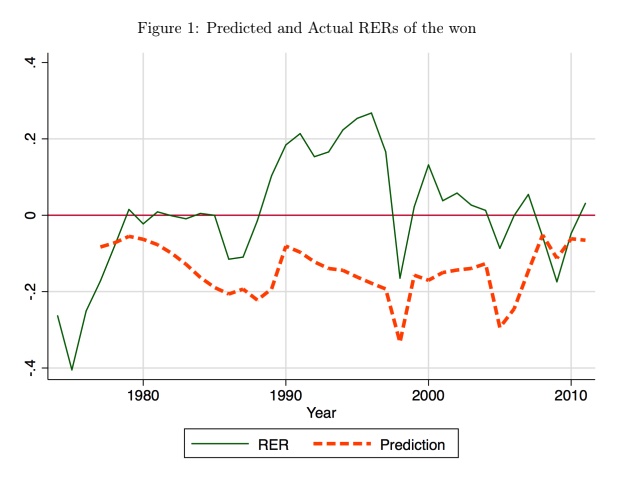

Existing theories on real exchange rates predict a significant undervaluation of the Korean won (KRW) in the early and mid-1990s. The paper demonstrates why this expectation did not materialize and instead an unprecedentedly large degree of overvaluation took place. Focusing on three variables, namely, financial repression, devaluation pass-through, and policy exhibitionism, the paper examines how the unraveling of the developmental state eventually gave rise to the 1990s’ overvaluation. It argues that the policy exhibitionism of the new civilian government amplified the influence of Chaebol on monetary policies, which in turn created a strong appreciative force to KRW. It also contends that the increasing exchange rate pass-through onto the prices of imported intermediate goods explains why Chaebol did not desire to tame the excessive appreciative trend despite its detrimental effect on their exports. The paper offers policy implications for other state-led, emerging economies.