Abstract

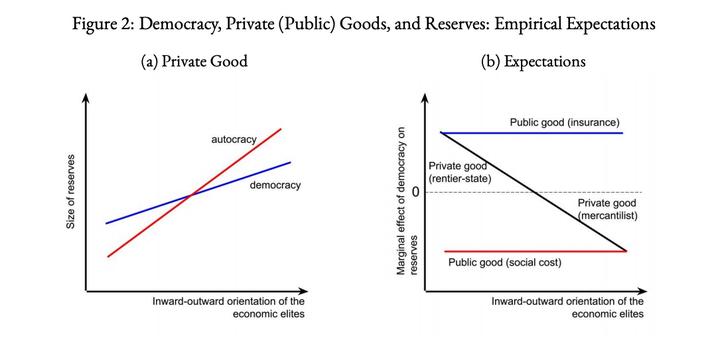

Does democracy affect foreign exchange reserves? This paper identifies four possible explanations for the determinants of foreign exchange reserves. Using the relationship between public goods provision and political regime types as a conceptual centerpiece, it offers a theoretical framework in which these four arguments are pit against each other. The “insurance” and “social cost” arguments posit monotonously positive and negative relationships between democracy and reserves, respectively, each citing democratic governments’ propensity to provide public goods such as financial stability and public spending. The mercantilist and rentier state arguments together put forth a conditional hypothesis that autocracies serve particularistic interests of outwardly (inwardly) oriented elites more than democracies do through weak-currency/large-reserve (strong-currency/small-reserve) policies. Utilizing panel data covering 127 countries from 1975 to 2012, I find that more democratic regimes are associated with larger (smaller) volumes of reserves when the size of exporting sectors is considerably small (large).